stock option exercise tax calculator

The company could award you a certain number of options but they might be vested over four years. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Exercise incentive stock options without paying the alternative minimum tax.

. Subtracting the 10000 it would cost to exercise the options shows a pre-tax. How much are your stock options worth. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant. VIX options and futures. The stock price is 50.

You own 10000 options one share per option to purchase common stock in your. On this page is an Incentive Stock Options or ISO calculator. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their.

Stock Option Tax Calculator. Your taxes will be paid on 10. When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price. This permalink creates a unique url for this online calculator with your saved information.

Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Cash secured put calculator addedcsp calculator.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Exercising stock options and taxes. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a. Stock Option Tax Calculator.

When you exercise youll pay. Please enter your option information below to see your potential savings. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Ad Trade on One of Three Powerful Platforms Built by Traders For Traders. Back to our example from before lets say you eventually sell your 10000 shares. When your stock options vest on January 1 you decide to exercise your shares.

Review Outputs of NSO Tax Calculator. On this page is a non-qualified stock option or NSO calculator. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator.

NSO Tax Occasion 1 - At Exercise. Ad Manage volatility w a tool that directly tracks the vol market. Heres an example of how the tax costs can play out with the exercising of stock options.

Exercise incentive stock options without paying the alternative minimum tax. Click to follow the link and save it to your Favorites so. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity.

According to the calculator at the end of five years 500 shares of stock will be worth 13224. The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. Calculate the costs to exercise your stock.

Stock options are a tool to build employee loyalty over time. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Ad SPX suite of index options offers an array of benefits and product features.

Stock Option Tax Calculator. From big to small find the right size to fit your options trading strategies. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Your stock options cost 1000 100 share options x 10 grant price. The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. You will only need to pay the greater of.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The Stock Option Plan specifies the total number of shares in the option pool. How much youre taxed.

Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Exercise incentive stock options without paying the alternative minimum tax. Calculate the costs to exercise your stock.

Incentive stock option iso calculator. Calculate the costs to exercise your stock options - including.

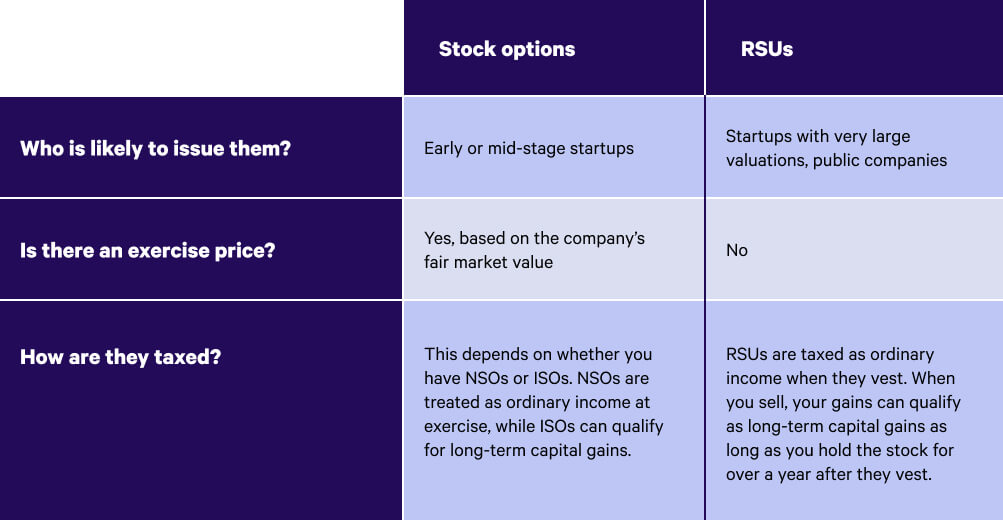

Rsus Vs Stock Options What S The Difference Wealthfront

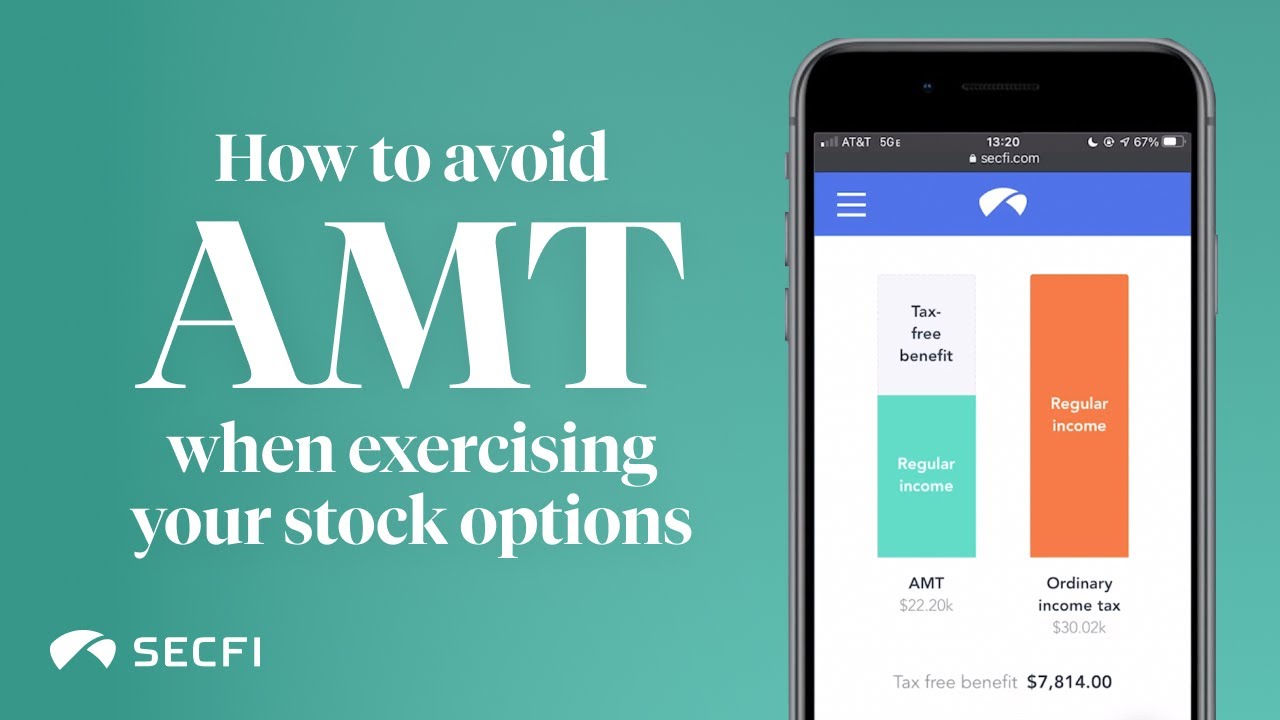

Secfi Stock Option Tax Calculator

Stock Based Compensation Back To Basics

Secfi Alternative Minimum Tax Calculator

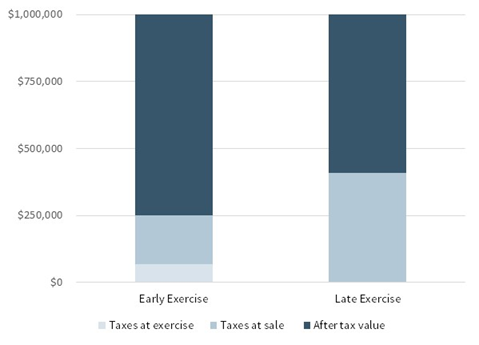

You Can T Afford To Make Poor Decisions About Incentive Stock Options Techcrunch

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

My Startup Stock Options Calculator Real Finance Guy

Stock Option Financing In Pre Ipo Companies

How Many Stock Options Should You Offer Employees This Simple Formula Will Tell You Inc Com

Changes To Accounting For Employee Share Based Payment The Cpa Journal

Nonqualified Stock Options And The Tax Impact Of Nsos Nerdwallet

What Is Exercise Price In Esops And How Is It Calculated Trica Equity Blog

Including Equity Compensation In A Financial Plan Charles Schwab

Secfi On Twitter If This Sounds Like You We Ve Got Just The Tool To Help Try Our Stock Option Tax Calculator Today Https T Co Ewkmnilxch Twitter

Employees Here S How Your Stock Options Impact Your Taxes

Employee Stock Option Fund Provides Easiest Way To Exercise Stock Options And Mitigates The Associated Risks Issuewire